The TRADEnosis Platform

It takes an orchestra of cloud-based servers to support trading systems using artificial intelligence.

Why haven't more algorithmic trading software companies adopted artificial intelligence (AI) in their trading strategies? A fellow trader recently showed machine learning code for stock trading written by a chatbot! Clearly, it's not the coding or even access to price and volume data. So, what's the problem? Well, that's like saying the secret to profits in the stock market is simply to buy low and sell high!

TRADEnosis is the result of two years of research and development, not in writing code, albeit devising ways to run thousands of AI models each night was a definite challenge, but rather developing the data 'features' needed to forecast future stock prices. In fact, that first step took decades of experience in technical trading!

For over a hundred years, technical analysis has relied on calculating derivatives of prices and volume (such as moving averages and relative strength) and on finding patterns (head & shoulders, double-tops, trend lines, support & resistance). If such relatively simple indicators ever worked in the past, individually, they have little predictive power now. Machine learning can find optimal combinations of technical indicators among trillions of permutations, so that's the place to start. But, it takes adding alternative data sources too. TRADEnosis employs alternative data like company financials, macroeconomics, trends in currencies & crypto, commodity prices, analyst and earnings reports, news and sentiment analyses, and international market metrics. These insights plus the advanced data handling and AI algorithms are what set TRADEnosis apart.

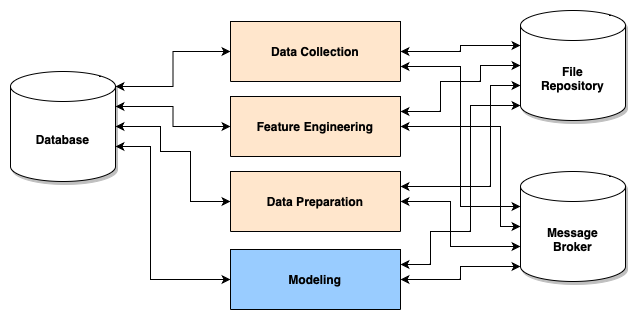

In summary, TRADEnosis is a sophisticated cloud-based platform that employs dozens of 'mini-servers' to collect data, undertake thousands of calculations and compile all that data for presentation to multiple machine learning algorithms. TRADEnosis is the infrastructure that makes it possible for artificial intelligence strategies, like QScore, to process hundreds of stocks each night and generate buy and sell signals.